California Wage & Hour Attorneys

The employment lawyers at Cutter Law P.C. hold California employers accountable when they require employees to work unreasonable hours without breaks, fail to pay minimum wage, and refuse to provide overtime compensation.

Federal and state employment laws require employers to pay fair compensation and provide employees with reasonable breaks. Employers may be liable for damages and can be forced by court order to comply when they fail to follow the law.

The California employment attorneys at Cutter Law P.C. help employees file wage and hour claims with the appropriate authorities and file lawsuits for damages that stem from employer violations of the law.

Class Action Alert: Save Smart Wage Theft

The class action seeks to recover millions of dollars in unpaid wages, penalties, and other damages on behalf of the affected employees and aims to compel Save Mart to change its employment practices.

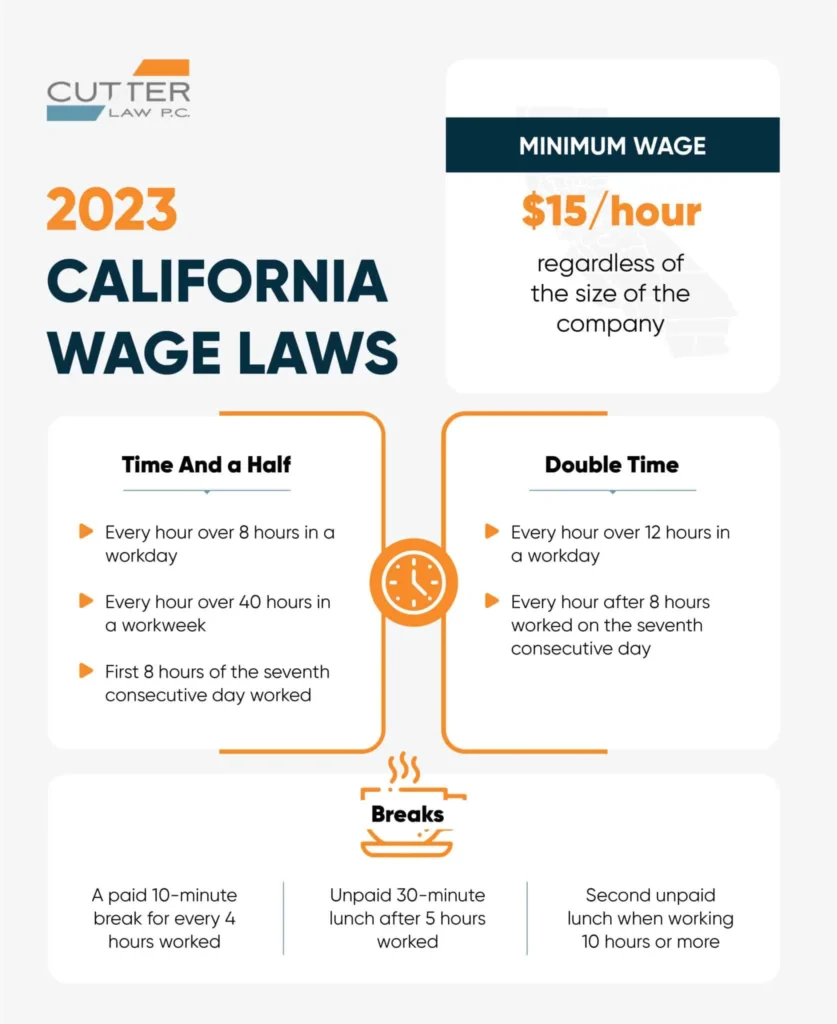

California Minimum Wage Requirements

Although the federal minimum wage is $7.25 per hour according to U.S. Department of Labor standards, the state of California has set a higher minimum wage that better reflects the cost of living in California. The minimum wage in California is $15 per hour for regular hours worked.

California employers are required to provide employees with an itemization of hours worked that shows their gross and net earnings.

"*" indicates required fields

What are the California overtime requirements?

State and federal laws also limit the number of hours employers can require employees to work at their regular rate. Employees who are required to work more than the maximum number of hours are entitled to overtime pay.

While the federal government only requires overtime pay when employees exceed 40 hours in a work week, the state of California has set increased standards for overtime pay.

Under California overtime laws, employees are entitled to receive overtime pay equal to at least time-and-a-half for the following hours worked:

- Every hour that exceeds eight hours in a workday

- Every hour that exceeds 40 hours in a workweek

- The first eight hours of the seventh consecutive workday

California requires employers to pay double time when work hours reach the following levels:

- Every hour in a workday that exceeds 12 hours

- Every hour on the seventh consecutive workday that exceeds eight hours

However, certain workers are considered exempt from overtime pay.

What is the difference between an exempt and non-exempt employee?

The U.S. Department of Labor defines an exempt employee as an employee whose compensation package passes the following three tests:

- The employee is paid a fixed salary

- The salary is at least $684 per week as of 2022

- The employee works in an executive, administrative, outside sales, or professional capacity

A non-exempt employee is entitled to minimum wage and overtime pay.

Are there exceptions to the overtime rules for non-exempt employees?

California labor laws allow employers to bypass overtime requirements in various circumstances. For example, employees will not be compensated for overtime hours if they work more than eight hours to voluntarily make up missed time during the same week for personal reasons.

Additional exceptions apply. Contact our employment attorneys to see if you fall under one of these exceptions.

When are employees entitled to take breaks?

According to California meal and rest break laws, employers must allow employees to take a 10-minute paid break for every four hours worked and an unpaid lunch break at least 30 minutes long after five hours of work. State law allows employees to opt out of taking the lunch break if they work up to six hours.

In addition, employees who work for 10 hours or more per day are entitled to a second unpaid lunch break, which they may voluntarily waive if work hours do not exceed 12 hours.

What are the most common wage and hour violations by employers?

Common wage and hour violations that employees file claims for include:

- Failure to pay minimum wage

- Misclassification of employees

- Failure to permit a break

- Failure to provide a lunch break

- Failure to pay for all time worked

- Failure to pay promptly

What if my employer is not paying me the correct wages?

The California Department of Industrial Relations accepts claims for minimum wage violations. An experienced employment law attorney can assist you with filing this claim and gathering the necessary documentation to support it.

Can I sue my employer for violating wage and labor laws?

California law allows employees to seek specific damages against employers who violate the law.

Denial of Breaks

If your employer fails to allow you to take your legally mandated breaks, you may be entitled to recover a full hour’s pay for each break you have been denied. This includes each paid lunch break and each paid rest period you have been denied, according to California § 11040.

Failure to Pay Minimum Wage and Required Overtime

If your employer fails to pay your wages in accordance with the law, you may be entitled to claim the following in a civil action per California § 1194 and § 1194.2:

- Back pay

- Liquidated damages

- Reasonable attorney fees

- Injunctive relief

Liquidated damages also include interest on unpaid wages. The court is not required to award liquidated damages on unpaid overtime. Injunctive relief may be an order for the employer to pay the correct wages.

Discrimination

California laws prohibit wage discrimination based on sex, race, or ethnicity. Wage variances may only be based on seniority, merit, or production quality or quantity. If you have been paid lower wages because of discrimination, you may sue for the following:

- The amount of wages of which you were deprived

- Interest on the wages you did not receive

- Liquidated damages in an amount equal to the actual damages

401 Watt Avenue Suite 100 Sacramento, CA 95864

1901 Harrison Street Suite 910 Oakland CA 94612

51 E St Santa Rosa, CA 95404

- California Wildfire Lawyer

- Eaton Fire Lawyer

- Our Story

- PG&E Lawsuit

- Wildfire Insurance Claim

- Camp Fire Lawsuit

- Dixie Fire Lawsuit

- Kincade Fire Lawsuit

- Mosquito Fire Lawsuit

- Saddleridge Fire Lawsuit

- FAQs

Get Help on Your Wage and Hour Claim From Our Skilled Employment Lawyers

Cutter Law P.C. is a nationally recognized law firm whose attorneys have more than 130 years of combined experience standing up to employers and large companies on behalf of harmed individuals. Our lawyers have won millions on behalf of employees who fought back against their employers.

Individuals face significant disadvantages when standing up to large companies, but when you hire Cutter Law P.C., you level the playing field by choosing an experienced firm with a vast network of resources. Our lawyers will protect your confidentiality and stop at nothing to ensure your employer compensates you fairly.

California limits the amount of time employees have to file hour and wage claims. Contact Cutter Law P.C. today to ensure you have sufficient time to file your claim. The initial consultation is free.

"*" indicates required fields

Start with a free consultation. We listen to what happened, how it’s affected your life, and what you need to move forward.

You’ll have a direct line to our attorneys. We keep communication open and ensure you always know what’s happening with your case.

From day one, we go all in—gathering evidence, negotiating with insurers, and preparing for trial if needed. You pay nothing unless we win compensation for you.

Key Takeaways If you were sexually assaulted in a rideshare, you may be entitled to compensation for your damages, which

A breach of contract is a failure to fulfill obligations, while fraud involves intentional deception for financial gain.

After a truck accident in California, get medical help, report the incident, gather evidence, and contact a truck accident lawyer to protect your rights.

As a family run California law firm we pride ourselves in providing every client personal attention and representation. The outstanding results we have gotten for our fire clients are a direct result of our commitment to understanding and presenting all aspects of their case.

Hear from our previous clients about the relationships we build together.

Celine Cutter has done a fantastic job negotiating with our insurance company with a possible bad faith claim. We had a house fire over a year ago and were getting nowhere until we hired Celine. She is a perfect combination of kind, compassionate and firm. Her communication has been excellent through the process and her knowledge of the law is very evident. We are so glad we have Celine in our corner.

Cutter Law is as good as it gets! Margot is an outstanding trial attorney. Not only does she have profound expertise in her field, but she also genuinely cares for her clients’ well-being. It’s rare to find such a combination of professional excellence and compassionate care. I highly recommend Cutter Law!

Brooks has a long-established, respected reputation as a skilled trial attorney and a record of proven success.