Personal injury and civil justice attorney Brooks Cutter is a leading advocate for consumer justice and protecting the rights of the severely injured…

California Wildfire Lawyer

Nothing can prepare you for the sheer loss and trauma a wildfire causes. You shouldn’t have to bear the burden alone. If someone else’s negligence caused a wildfire that resulted in financial, physical, or emotional damages, you may be eligible to seek compensation against the liable party. When you turn to Cutter Law, you’ll find a fierce and experienced team of California wildfire lawyers ready to fight for your rights and help you rebuild your life.

UPDATE: We are currently accepting cases for the Eaton wildfire in Los Angeles.

Quick Links

- Why Choose Our Wildfire Attorneys at Cutter Law?

- Who Can Be Liable for Wildfire Damage?

- What Damages Can I Claim in a Wildfire Lawsuit?

- How Do I Know if I’m Entitled to Compensation From the Utility Company?

- Can I File a Wildfire Lawsuit if I Don’t Have Insurance?

- How Can the Wildfire Attorneys at Cutter Law Help Me?

- Frequently Asked Questions

- Wildfire Support Resources

Why Choose Our Wildfire Attorneys at Cutter Law?

At Cutter Law, we have seen first-hand the devastation a catastrophic wildfire can leave behind. In 2017, attorney John Roussas’ family lost their dream home and life time’s memories to the Tubb’s Fire in Fountain Grove. They had just moments to evacuate and returned to find the wreckage of the home they had poured their love into for 25 years. Their story is not unique—3,000 families lost their homes that day, and many more suffer profound losses each year throughout California.

Our firm applies this personal understanding to every wildfire lawsuit we handle. Since the Tubb’s Fire, our team has dedicated ourselves to helping families who lose everything to California wildfires. Our attorneys have successfully recovered hundreds of millions of dollars for injured clients and their families, many of whom suffered damages due to wildfires, so they can start rebuilding their lives. We are passionate about helping wildfire victims navigate their rights, options, and resources in what may be the most challenging time of their lives. You can expect this same level of dedication if you entrust us with your case.

Our Wildfire Attorneys

See What Our Wildfire Client Says

"Celine Cutter has done a fantastic job negotiating with our insurance company with a possible bad faith claim. We had a house fire over a year ago and were getting nowhere until we hired Celine. She is a perfect combination of kind, compassionate and firm. Her communication has been excellent through the process and her knowledge of the law is very evident. We are so glad we have Celine in our corner."

Who Can Be Liable for Wildfire Damage?

Any person or organization that acts negligently or intentionally and causes a wildfire to ignite or spread can be liable for the resulting damages. Many times, the liable party is a utility company, such as PG&E, Southern California Edison, and PacifiCorp.

If a utility company’s negligent actions or inactions contributed to the wildfire that caused you harm, you may be eligible to file a lawsuit against it. Our fire attorneys have found success in holding large California utility companies accountable for their role in causing wildfires. Your legal options may include filing a property damage claim, a personal injury lawsuit, or a wrongful death action.

Examples of Negligence by a Utility Company

Utility companies are often responsible for wildfires. They operate and maintain potentially dangerous electrical equipment, such as power lines, cables, transformers, and poles. When these companies fail to properly adhere to safety protocols for their equipment, they can spark a wildfire when weather conditions are dry and windy.

Some examples of negligent, careless, or deliberate behavior by a utility company that could result in wildfire liability include:

- Failure to remove trees that could fall onto power lines and ignite a fire

- Failure to trim or clear vegetation near power lines

- Failure to shut off power during high-risk conditions

- Failure to maintain equipment properly

- Failure to repair or replace faulty equipment

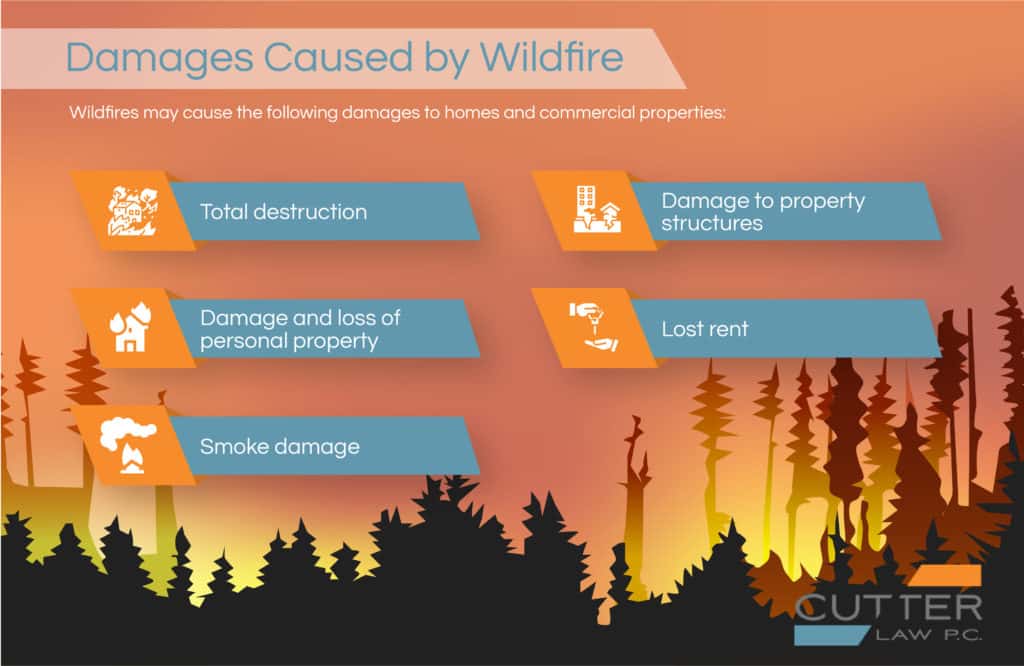

What Damages Can I Claim in a Wildfire Lawsuit?

In a wildfire case, you can claim damages for any economic and non-economic losses you suffered from the fire, such as the following:

- The costs related to any injuries, including medical treatment, long-term care, or disability accommodations

- Lost income due to the destruction of your business or loss of employment

- Property damage, including damage to your home or its surrounding landscape, vehicles, and personal belongings

- Evacuation and alternative living arrangement costs

- Pain and suffering, including emotional distress

- Wrongful death damages

Punitive damages may also be available if the liable party has consciously disregarded the rights or safety of others. These damages are meant to punish the liable party and prevent future misconduct.

Can a Utility Company Be Sued for Wrongful Death From a Wildfire?

If a loved one has died from a wildfire caused by someone’s negligence or misconduct, you may be eligible to sue that party for wrongful death damages. Examples of wrongful death damages include the loss of the deceased’s financial support and benefits, funeral and burial expenses, and the loss of love and companionship.

How Do I Know if I'm Entitled to Compensation From the Utility Company?

In general, anyone who has suffered harm or sustained losses due to the wildfire may seek compensation from any responsible party, including any liable utility companies. This includes those who suffered property damage or bodily injuries due to direct contact with the flames and smoke. In addition, those who suffered indirect harm. For example, if you had to evacuate your home due to the fire, even if the fire never touched your property, you could recover damages for any mental anguish or emotional distress you suffered due to the evacuation.

You may also be entitled to compensation if smoke or soot from the fire damaged your property or caused inhalation-related bodily injuries. Additionally, if firefighters’ efforts to contain the fire caused water or mold damage to your property, you could recover damages from the utility company.

Certain family members of individuals who died from the fire are also entitled to compensation. In general, California law gives priority for filing a wrongful death lawsuit to the deceased’s surviving spouse or domestic partner, surviving children, and the children of any deceased child.

The best way to determine if you’re entitled to compensation for wildfire damages is to speak with a California wildfire lawyer. The experienced wildfire attorneys at Cutter Law can investigate the fire, determine the cause, and identify who is responsible for causing it.

Can I File a Wildfire Lawsuit if I Don't Have Insurance?

In general, you do not need to have insurance coverage to file a wildfire lawsuit. If a utility or other third party caused the fire, you are entitled to compensation for your damages, whether you have insurance or not.

Thus, both insured and uninsured individuals may recover compensation in a California wildfire lawsuit.

Insurance claims may still play a role in the wildfire damage litigation process. If you have homeowners’ insurance, you can pursue a claim for replacement or repair of your home and outbuildings, replacement of your personal property, and lodging while you cannot live in your home.

However, homeowners’ coverage does not cover all of your losses. If your damages exceed your insurance coverage, you could file a lawsuit for your remaining damages.

How Can the Wildfire Attorneys at Cutter Law Help Me?

Getting the compensation you deserve after a wildfire is never easy. Even if your damages are less than your insurance policy limit, your insurance company may still deny or undervalue your claim. Many homeowners are underinsured and must seek compensation directly from the liable utility companies. Those utility companies have seasoned lawyers and other professionals working for them who will do everything they can to limit their liability. Cutter Law can level the playing field and fight for full and fair compensation on your behalf.

Our attorneys have extensive experience representing people whose lives have been turned upside down by wildfires. When you turn to us, we’ll listen to your story and inform you of your options and what to expect, including timelines, necessary documentation, and the steps ahead.

If we proceed with a case, we’ll thoroughly investigate the wildfire incident. We’ll gather strong evidence, including expert witnesses or forensic analysis, to demonstrate the utility company’s liability and your resulting damages. Our team will guide you through each phase of the legal process for filing a lawsuit and pursuing compensation. Contact us today for a free, no-obligation consultation.

Frequently Asked Questions

It’s natural to have questions after experiencing a catastrophic wildfire. Here are some answers to common questions our clients have asked us.

What Is the Statute of Limitations for Filing a California Wildfire Lawsuit?

The deadline for filing a lawsuit depends on the type of claim you are pursuing. California’s statute of limitations for property damage is three years from the date the damage occurred. The statute of limitations for personal injury or wrongful death is two years from the date of the injury or death.

How Long Does a Wildfire Lawsuit Against a Utility Company Typically Take?

No two wildfire lawsuits are the same, and their duration can vary from several months to several years. Factors influencing how long it takes to get compensation from a utility company include the case’s complexity, the amount of evidence available, and whether the case settles out of court or goes to trial.

What Should I Do To Prepare for Filing a Wildfire Lawsuit?

If you’re considering filing a wildfire lawsuit, the following steps can help you prepare:

- Document all property damage and bodily injuries.

- Keep track of all expenses related to the wildfire, such as evacuation costs, property repairs, and medical bills.

- Gather any available evidence that may support your case, such as witness statements or news articles.

- Report the damages to your insurance company and keep a record of all correspondence related to your claim.

- Consult a California wildfire lawyer at Cutter Law to discuss your next steps.

Wildfire Support Resources

Here are some additional resources for help following a wildfire:

Schedule A Free Case Review

"*" indicates required fields

Our Office Locations

Sacramento Office

401 Watt Avenue Suite 100

Sacramento, CA 95864

Phone: 916-290-9400

Oakland Office

Cutter Law P.C.

1901 Harrison Street Suite 910

Oakland, CA 94612